how are rsus taxed when sold

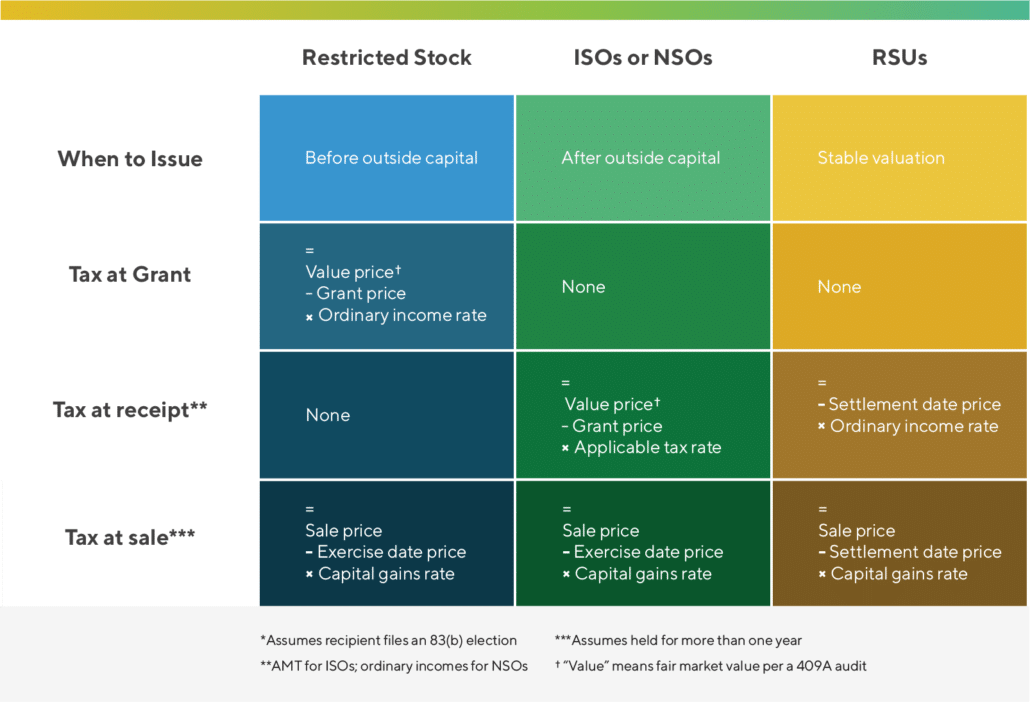

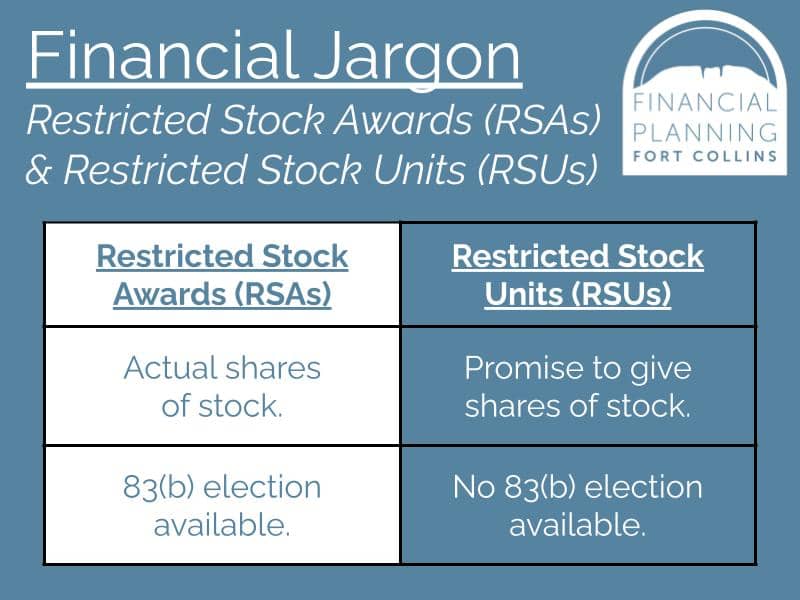

RSUs are taxed at the. Restricted stock and RSUs are taxed differently than other kinds of stock options suThe amount that must be declared is determined by subtracting the original purchase or exercise price of the stock which may be zero from the fair market value of the stock as of the date that the stock becomes fully vested.

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

At any rate RSUs are seen as supplemental income.

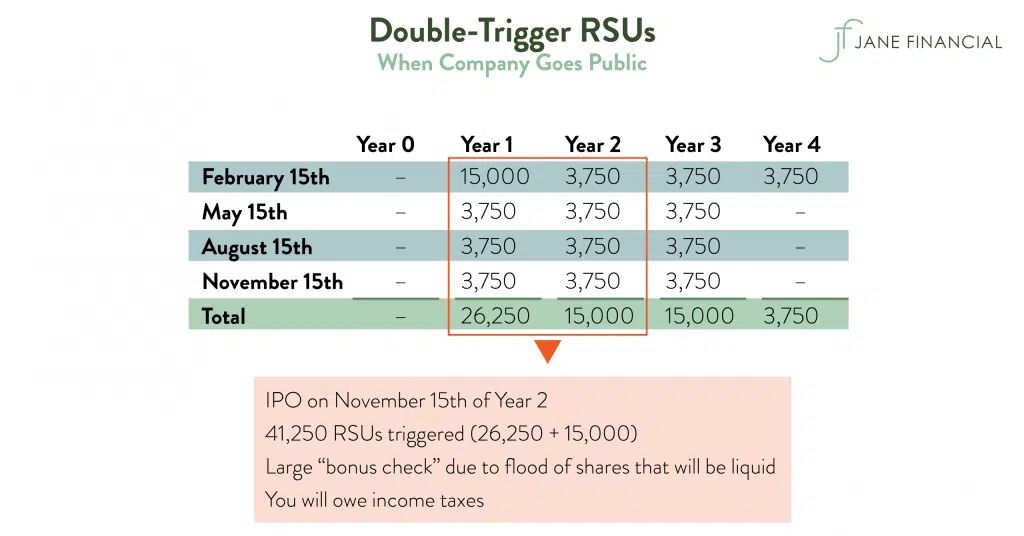

. RSUs are the most common way that public companies grant company stock to employees. Because the RSUs pushes your total income above 100000 you will pay 60 income tax on the RSUs. The vested RSUs will be presented as income during.

Few people understand all the various taxes that come into play when you receive a paycheck or when an RSU vests. For example where FMV is 1000 and number of units shares vested is 100. The chart above shows that the employee sold some of the shares each year to pay taxes.

If held beyond the vesting date the RSU tax when shares are sold is. What rate are RSUs taxed at. If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well.

This is known as the 60 tax trap. Long-term capital gains are taxed at a rate of 0 15 or 20 depending on your taxable income and marital status. The RSU taxation includes state and local taxes federal income taxes medical social.

In the case that you hold the shares. Long-term capital gains rates are likely the lowest tax on. RSU tax at vesting date is.

The RSU tax rate is the same as the income tax rate. The differenc See more. RSUs and Capital Gains Taxes.

For every 2 you earn above 100000 your. Capital gains tax only applies if the recipient of RSUs does not sell the stock. Since its taxed as wage income you may also.

Taxable income is the Fair Market Value FMV at vesting. The four taxes youll owe when you receive a paycheck or. You will be charged tax on the vesting date or on the date the shares pass to you if earlier.

Most companies will withhold federal income taxes at a flat rate of 22. Your employer will make the necessary deductions through payroll and pay the tax. RSUs are taxed at vesting.

For example if 10 RSUs vest when the market price is 50 youll add 500 to your wage income and will be taxed accordingly. When RSUs vest and the shares are sold immediately you are taxed at the ordinary income rate. No RSUs are not taxed twice.

The of shares vesting x price of shares Income taxed in the current year. At the time that these RSUs are received by the taxpayer part of them are actually. If you hold the stock for.

Until 5 April 2016 normally the securities would be taxed as moneys worth under ITEPA03S62 see ERSM20500 when they were acquired and the grant of the RSU would not be moneys. However it can seem like RSUs are taxed twice if you hold onto the stock and it increases in value before you sell it. The RSU taxation includes state and local taxes federal income taxes medical social security taxes and others.

When RSUs are issued to an employee or executive they are subject to ordinary income tax. The value of over 1.

Rsu And Taxes Restricted Stock Tax Implications

When Do I Owe Taxes On Rsus Equity Ftw

Stock Options And Other Equity Compensation Strategies Founders Circle

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

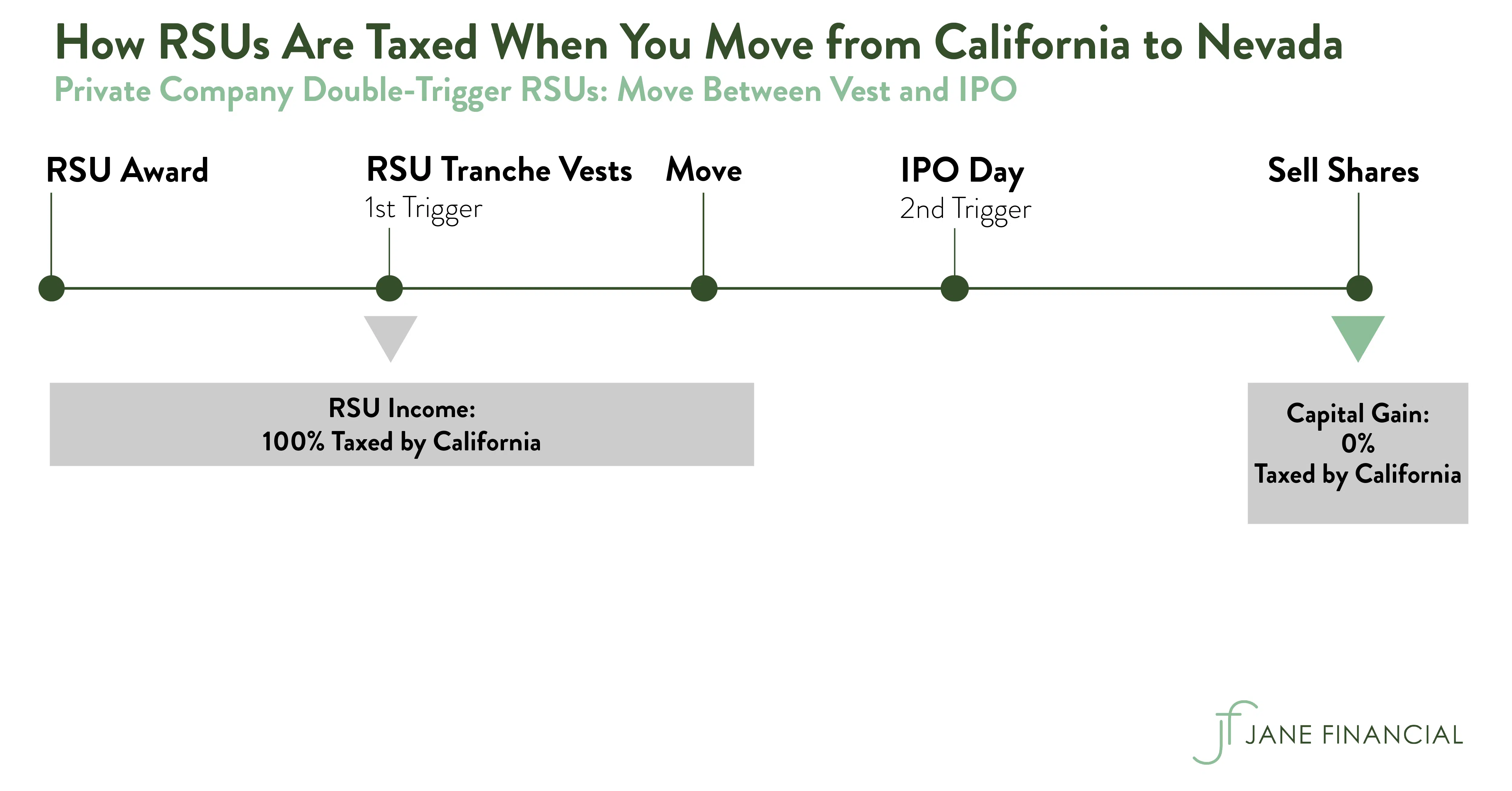

Restricted Stock Units Jane Financial

Transitioning From Stock Options To Rsus Pearl Meyer

Stock Based Compensation Back To Basics

Tax Basis And Stock Based Compensation Don T Get Taxed Twice

All About Rsus And Rsas Too Financial Planning Fort Collins

How To Avoid Taxes On Rsus Equity Ftw

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Should I Sell My Restricted Stock Units Rsus Right Away Vested Financial Planning San Carlos Ca

Rsus A Tech Employee S Guide To Restricted Stock Units

Stock Options Vs Rsu Differences And Similarities Financial Falconet

Should I Sell My Restricted Stock Units Rsus Right Away Vested Financial Planning San Carlos Ca

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

How Many Of My Rsus Should I Sell Flow Financial Planning Llc